Refer to Figure 4-16. Suppose the market is initially in equilibrium at price P1 and now the government imposes a tax on every unit sold. Which of the following statements best describes the impact of the tax? For demand curve D1

A) the producer's share of the tax burden is the same whether the supply curve is S1 or S2.

B) the producer bears a greater share of the tax burden if the supply curve is S2.

C) the producer bears a greater share of the tax burden if the supply curve is S1.

D) the producer bears the entire burden of the tax if the supply curve is S1 and the consumer bears the entire burden of the tax if the supply curve is S2.

B

You might also like to view...

If a 4 percent rise in the price of peanut butter lowers the total revenue received by the producers of peanut butter by 4 percent, the demand for peanut butter

A) is elastic. B) is inelastic. C) is unit elastic. D) has an elasticity of 2.0.

A Nash equilibrium is:

A. an outcome in which all players choose the best strategy they can, given the choices made by all of the other players. B. when one strategy is always the best for a player to choose, regardless of what other players do. C. an outcome in which all players follow a "leader" in order to maximize profits. D. None of these statements is true.

Which of the following is true of the federal budget? a. The federal budget is a plan that describes a government's monetary policy for the current financial year

b. The federal budget is a plan that describes a government's fiscal policy for the current financial year. c. The federal budget is a plan that describes the president's take on the economy. d. The federal budget is a plan for federal government outlays and revenues for a specified period, usually a year. e. The federal budget is a plan that describes the eligibility criteria of the major entitlement programs taken up by Congress for the current financial year.

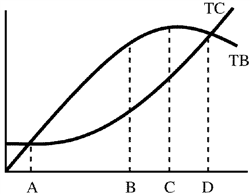

Figure 7-3

Government provides many goods and services to the public because they are not provided by free markets. Some economists believe bureaucrats who manage the programs have no interest in maximizing net benefits (profits) but instead maximize the size of a program constrained only by the need to have total benefits exceed total costs. Figure 7-3 shows total benefits and cost curves for a program. What point is the efficient point, and what point will the bureaucrat choose?

a.

A and B, respectively

b.

B and D, respectively

c.

D and C, respectively

d.

D and A, respectively