Exchange controls used by a country's government to maintain an overvalued exchange rate result in considerable costs to the country. Explain the situation with a diagram and use it to show the deadweight loss. Explain why bribery and parallel markets can arise in economies with exchange controls.

What will be an ideal response?

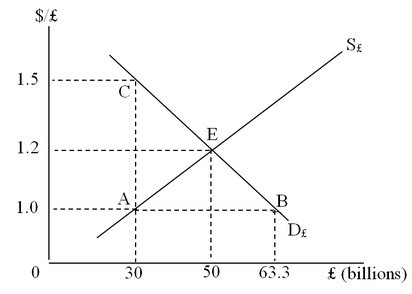

POSSIBLE RESPONSE: Assume that a government has become committed to maintaining a fixed exchange rate that officially values foreign currencies less, and the domestic currency (here the dollar) more, than the free market equilibrium rate. The official rate is, say, $1.0 per pound sterling. The exchange control requires exporters to turn over all their revenues from foreign buyers to the government. The government, in turn, gives them $1.0 in domestic bank deposits for each pound sterling they have earned. The government then allocates the dollars to those who want to conduct international activities.

In the figure above, we see the foreign exchange market. D£ and S£ are the demand and supply curves of pound sterling in the foreign exchange market. In this figure, the exchange control limits the foreign currency available to 30 billion pounds. This is the amount earned by the country's exporters at the official exchange rate of $1.0 per pound. Even if those who most value the limited foreign currency (those at the top part of the demand curve) get it, the country suffers a loss of well-being equal to the triangular area CEA, which is the deadweight loss.

Exchange control regimes encourage efforts to evade exchange controls. People are frustrated when they are not allowed to buy foreign exchange, even though they are willing to pay more than the official exchange rate. The frustrated demanders will look for other ways to obtain foreign exchange. One way is to bribe the government functionaries in charge of determining the official allocations. Another way is to offer more to recipients of foreign exchange than the government is offering. In this way a second foreign exchange market, a parallel market or black market, develops as a way for private demanders and sellers of foreign exchange to evade exchange controls.

You might also like to view...

Empirical evidence from electric-power-producing firms suggests that

A) all electric-power-producing firms are natural monopolies. B) no electric-power-producing firms are natural monopolies. C) the largest electric-power-producing firms are natural monopolies. D) the smallest electric-power-producing firms are natural monopolies.

Which of the following grew rapidly during the years following the passage of the Medicare and Medicaid programs?

a. the share of healthcare expenditures financed by third parties b. the prices of healthcare relative to the prices of other goods and services c. expenditures on healthcare as a share of the economy d. all of the above

Imagine two economies that are identical except that, for a long time, economy A has had a money supply of $1,000 billion while economy B has had a money supply of $1,500 billion. It follows that

a) the price level, but not real GDP is higher in country B. b) real GDP and the price level are higher in country B. c) real GDP, but not the price level, is higher in country B. d) neither the price level or real GDP is higher in country B.

How would an economist characterize the decision to change brands when the price of one’s preferred brand increases?

a. disloyal b. rare c. rational d. unnecessary