Thomas Hobbes argued for a tax on consumption instead of on income because

A. the standard of living depends not on income, but on how much income is spent.

B. a tax on consumption raises more revenue than a tax on income.

C. a tax on income discourages saving by taxing savings twice.

D. consumption is the best indication of ability to pay.

Answer: A

You might also like to view...

Refer to Figure 9.6. Before this policy was implemented, consumer surplus was

A) $20. B) $4000. C) $6000. D) $8000. E) $12000.

Refer to the above figure. An external benefit exists. The amount of that benefit is represented by

A) P4. B) the vertical distance between D1 and D2. C) the distance between G and F. D) P3.

Core inflation is a measure of:

A. inflation that excludes goods with historically volatile price changes. B. an overall rise in prices in the economy. C. the Consumer Price Index with durable goods excluded. D. the change in the Consumer Price Index with durable goods excluded.

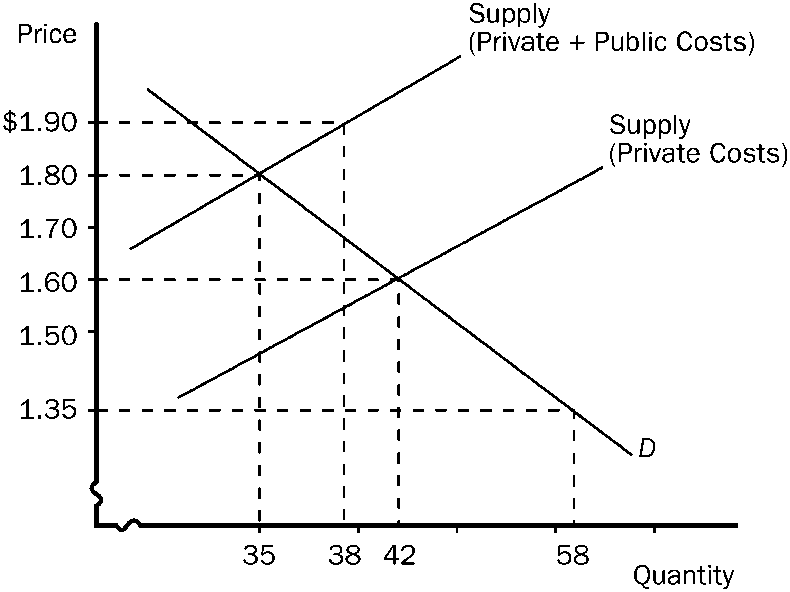

Figure 5-4

Refer to . The figure illustrates an industry that generates

a.

external benefits.

b.

external costs.

c.

no externalities.

d.

economies of scale.