The effective rate of interest for a particular bond issue is the market rate of interest for other investments with similar levels of risk.

Answer the following statement true (T) or false (F)

True

Bonds are issued at a premium or at a discount when the stated rate is not equal to the rate of similar investments in order to produce an effective rate equal to that of those similar investments.

You might also like to view...

Suppose you buy an inflation-indexed bond that will adjust with inflation and thus pay you $1,500 in real (inflation-adjusted) terms in one year. The nominal interest rate is 4 percent and the expected inflation rate is 2 percent. What is the present value of the bond? (Round off your answer to the nearest dollar and pick the answer closest to the one you calculate.)

A. $1,415 B. $1,442 C. $1,471 D. $1,530

In testing plant and equipment balances, an auditor may physically inspect new additions listed on the summary of plant and equipment transactions for the year. This procedure is designed to obtain evidence concerning management's assertions about classes of transactions and events, and specifically, which assertion?

A. Authorization. B. Occurrence. C. Classification. D. Cutoff.

Which of the following is not something a model of database structures must be able to describe?

A. The attributes or characteristics of the entities and relationships. B. The sequence that entities are accessed. C. The entities or things in the domain of interest. D. The cardinalities that describe how many instances of one entity can be related to another.

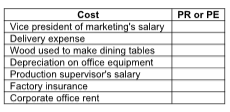

Classify each cost of a furniture manufacturer as either a product cost (PR) or a period cost (PE).