The marginal income tax rate is the ________

A) total tax paid by an individual divided by the total income earned

B) difference between the highest and lowest income tax rates charged by a state

C) percentage of the last dollar earned that a household pays in taxes

D) total revenue received by the government divided by the number of taxpayers

C

You might also like to view...

Refer to the scenario above. Each firm will face a demand of ________ units of Good A if both of them charge a price of $60

A) $1,000 B) $1,500 C) $2,000 D) $3,000

Describe the pattern of growth rates in real GDP per hour worked in the United States since the early nineteenth century. Has output per hour worked consistently increased at the same rate? Explain

What will be an ideal response?

Compare and contrast a general retail sales tax with a value added tax

What will be an ideal response?

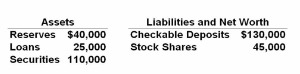

Assuming a legal reserve ratio of 20 percent, how much in excess reserves would this bank have after a check for $10,000 was drawn and cleared against it?

Assume the Continental National Bank's balance statement is as follows:

A. $3,000.

B. $24,000.

C. $6,000.

D. $16,000.