When taxes or subsidies on a particular product are introduced into the general equilibrium model we can be sure that

A. subsidies make the product appear too cheap to its producer.

B. we get too much of the subsidized product and too little of the taxed product.

C. a more fair allocation of resources is possible.

D. taxes make the taxed product appear too expensive to its producer.

Answer: B

You might also like to view...

In our study of monopoly, we found that monopolists can increase profit by segmenting the market and price discriminating (under third degree price discrimination). Now suppose a firm is producing an excludable local public good. Can you justify a form of such market segmentation and price discrimination as efficient?

What will be an ideal response?

Collusion between two firms occurs when

A) announce that each will match its rival's market price. B) firms explicitly or implicitly agree to adopt a uniform business strategy. C) the firms independently pursue strategies that could hurt each other. D) firms act altruistically to bring about the economically efficient outcome.

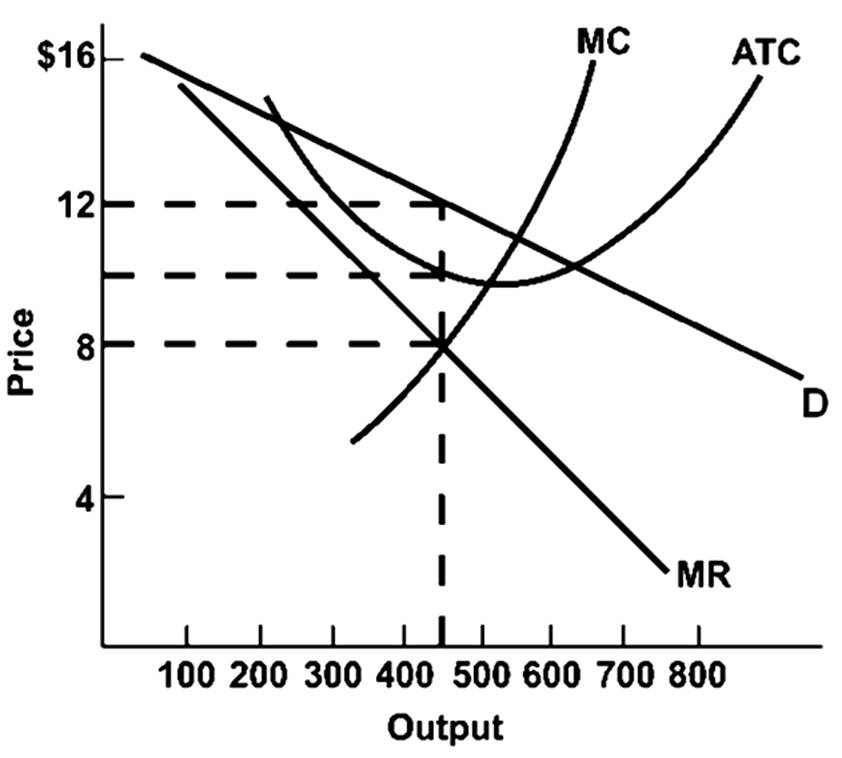

If profit-maximizing, this firm will charge a price of

A. $8.

B. $10.

C. $12.

D. $16.

Suppose that over the past year, the nominal interest rate was 5 percent, the CPI was 150.3 at the end of the year, and the CPI was 144.2 at the beginning of the year. It follows that

a. the dollar value of savings increased at 5 percent, and the purchasing power of savings increased at 0.8 percent. b. the dollar value of savings increased at 5 percent, and the purchasing power of savings increased at 9.2 percent. c. the dollar value of savings increased at 0.8 percent, and the purchasing power of savings increased at 5 percent. d. the dollar value of savings increased at 9.2 percent, and the purchasing power of savings increased at 5 percent.