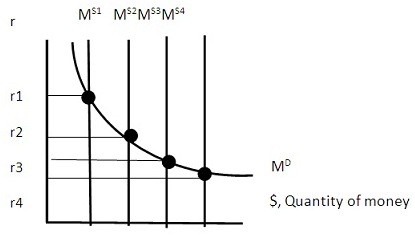

If the money supply in the economy were at MS2, and the Federal Reserve Bank used open market operations to move money supply to MS3, the overall direct result in the economy would be:

A. LRAS move to the FE level of output.

B. Aggregate demand shifted in, causing GDP to fall.

C. Aggregate demand shifted out, causing GDP to rise

D. Aggregate supply shifted in, causing GDP to fall.

Answer: C

You might also like to view...

Suppose that the federal government had a budget deficit of $80 billion in year 1 and $90 billion in year 2, but that it experiences budget surpluses of $40 billion in year 3 and $20 billion in year 4

Also assume that the government uses any budget surpluses to pay down the public debt. At the end of these four years, the Federal government's public debt would have A) increased by $110 billion. B) decreased by $57.5 billion. C) increased by $230 billion. D) decreased by $110 billion.

The larger the fraction of an investment financed by borrowing,

A) the smaller the potential return and potential loss on that investment. B) the greater the potential return and the smaller the potential loss on that investment. C) the smaller the potential return and the greater the potential loss on that investment. D) the greater the potential return and potential loss on that investment.

A quota typically increases the volume of imports, whereas a tariff typically decreases the volume of imports

a. True b. False

Government failure may occur die to:

a. short run focus of elected officials b. special-interest group influence c. difficulty is measuring the marginal social benefit and the marginal social cost of government spending d. all of the above