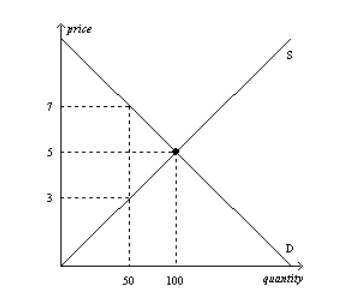

Refer to Figure 6-19. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

a. $3

b. Between $3 and $5

c. Between $5 and $7

d. $7

Ans: c. Between $5 and $7

You might also like to view...

The employment-to-population ratio is defined as

A) total employment divided by labor hours then multiplied by 100. B) the labor force divided by the working-age population then multiplied by 100. C) total employment divided by the labor force then multiplied by 100. D) total employment divided by the working-age population then multiplied by 100.

Producer surplus is the

A) cost of the good summed over the quantity sold. B) demand for a good minus the supply summed over the quantity sold. C) price of a good minus the marginal cost of producing it summed over the quantity sold. D) marginal cost of producing it summed over the quantity sold.

Government is designed to handle problems not addressed by the private sector.

A. True B. False C. Uncertain

The Cournot theory of oligopoly assumes rivals will:

A. keep their output constant. B. follow the learning curve. C. decrease output whenever a firm increases its output. D. increase their output whenever a firm increases its output.