The personal distribution of income in the United States shows that

A) income is equally distributed.

B) the poorest 20 percent of individuals receive approximately 20 percent of total income.

C) the richest 20 percent of individuals receive approximately 50 percent of total income.

D) the poorest 60 percent of individuals receive approximately 50 percent of total income.

E) the richest 20 percent of individuals receive approximately 25 percent of total income.

C

You might also like to view...

You bought some shares of stock and, over the next year, the price per share increased by 5 percent, as did the price level. Before taxes, you experienced

a. both a nominal gain and a real gain, and you paid taxes on the nominal gain. b. both a nominal gain and a real gain, and you paid taxes only on the real gain. c. a nominal gain, but no real gain, and you paid taxes on the nominal gain. d. a nominal gain, but no real gain, and you paid no taxes on the transaction.

Recall the Application about setting the price of tickets for Major League Baseball games to answer the following question(s).According to the Application, the marginal revenue from ticket sales for a typical Major League Baseball team is:

A. positive. B. zero. C. negative. D. infinity.

The person least likely to receive a payment from a corporation in a year of losses is the

A. bondholder. B. preferred stockholder. C. common stockholder. D. bank that loaned money to the corporation.

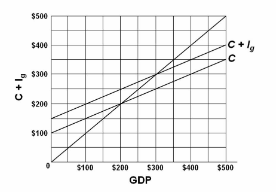

Refer to the diagram for a private closed economy. At the equilibrium level of GDP, investment and saving are both:

A. $50.

B. $100.

C. $20.

D. $40.