A tariff differs from a quota in that a tariff is:

A. levied on imports, whereas a quota is imposed on exports.

B. levied on exports, whereas a quota is imposed on imports.

C. a tax levied on exports, whereas a quota is a limit on the number of units of a good that can be exported.

D. a tax imposed on imports, whereas a quota is an absolute limit to the number of units of a good that can be imported.

Answer: D

You might also like to view...

Why does the history of the U.S. matter?

(a) Historical knowledge helps us understand the forces that shaped the current economy. (b) The lessons of the past help us avoid future mistakes. (c) Historical knowledge helps us identify who or what is most likely to fuel future economic prosperity. (d) All of the above.

The best measure of money is

A) coins and currency. B) the one based on the transactions approach. C) the one based on the liquidity approach. D) something economists have never agreed on.

The practice of buying a firm's good in one market at a low price and selling it in another market for a higher price in order to profit from the price difference is known as

a. Predatory pricing b. Price collusion c. Arbitrage d. Mark-up pricing

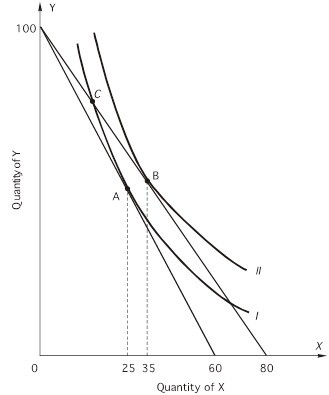

Based on the following graph, at point C, The consumer's income is $600.

The consumer's income is $600.

A. MRS is less than 2.5. B. MRS is greater than 1.25. C. MRS is greater than 2. D. MRS is less than 0.4.