Refer to Table 18-9. Sylvia is a single taxpayer with an income of $70,000. What is her marginal tax rate and what is her average tax rate?

A) marginal tax rate = 8%; average tax rate = 19.3%

B) marginal tax rate = 30%; average tax rate = 22.5%

C) marginal tax rate = 20%; average tax rate = 30%

D) marginal tax rate = 30%; average tax rate = 30%

B

You might also like to view...

Refer to the above figure. Excess quantity supplied will exist when

A) the price equals $10. B) quantity demanded equals 3. C) the price equals $6. D) the price is between $0 and $6.

The prospect of a recession in the United States would probably cause the dollar to

a. depreciate because interest rates would be expected to rise. b. depreciate because imports would be expected to rise. c. appreciate because imports would be expected to fall. d. appreciate because interest rates would be expected to decrease.

In 2009, which category accounted for the highest share in the U.S. exports?

a. Industrial supplies b. Capital goods c. Services d. Consumer goods

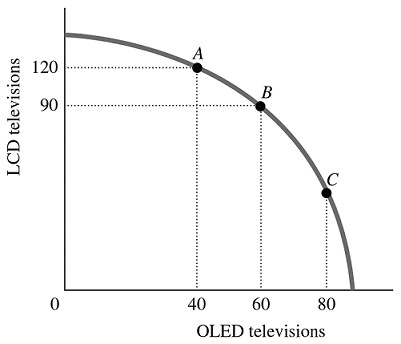

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The best point for society would be

Figure 2.5Refer to Figure 2.5. The best point for society would be

A. either Point B or Point C, as the total amount being produced at either of these points is approximately the same. B. at any of the labeled points, as all of the points represent an efficient allocation of resources. C. Point C, as at this point there are approximately equal amounts of LCD and OLED televisions being produced. D. indeterminate from this information, as we don't have any information about the society's desires.