In the U.S., in recent years, comparing M2 to M1 in terms of dollar value, we can say that M2

a. has grown considerably slower than M1 but is still about three times its size

b. has grown faster than M1 and is about three times its size

c. has grown faster than M1 but is still less than half the size of M1

d. has grown considerably slower than M1 and is less than half the size of M1

e. is about the same size as M1, varying only slightly with changes in money velocity

B

You might also like to view...

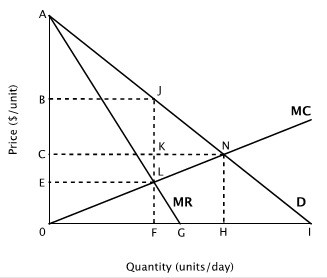

Suppose the figure below shows the demand curve, marginal revenue curve and marginal cost curve for a monopolist.  At this monopolist's profit-maximizing level of output, its total revenue equals the area:

At this monopolist's profit-maximizing level of output, its total revenue equals the area:

A. 0FLE. B. ELJB. C. 0HNC. D. 0FJB.

Which of the following fiscal policy changes would be the most expansionary?

A. A $20 billion tax cut and $20 billion increase in government purchases B. A $40 billion tax cut C. A $10 billion tax cut and $30 billion increase in government purchases D. A $40 billion increase in government purchases

Refer to Table 4.2. If you choose to invest in Japanese bonds, your investment return from Scenario C will be

A) -3%. B) -1%. C) 2%. D) 5%.

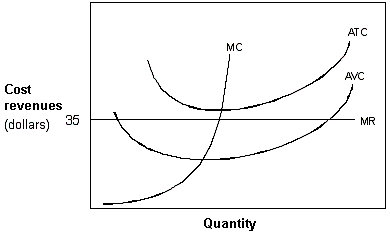

Exhibit 8-8 A firm's cost and marginal revenue curves

A. This firm should shut down. B. This firm could increase profits by increasing output. C. This firm could increase profits by decreasing output. D. This firm should continue to operate at its current output.