An example of fiscal policy occurs when the government decreases corporate income taxes.

Answer the following statement true (T) or false (F)

True

Fiscal policy is the use of government taxes, including taxes on corporate income and spending to alter macroeconomic outcomes.

You might also like to view...

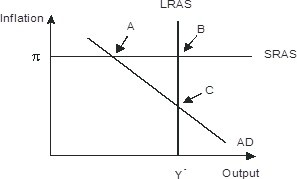

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________.

A. Rising; A B. Falling; A; C C. Falling; B: C D. Rising; A; C

Which statement about price elasticity of demand along a linear demand curve is true?

a. As the quantity demanded increases, so does the buyer's sensitivity to price. b. When price elasticity of demand is equal to 1, consumers are indifferent to subtle price changes. c. The ratio of current price to quantity demanded is a good estimate of the elasticity of demand. d. As the prices of goods increase, the elasticity of demand increases. e. When an individual buys 4 units of a good his/her elasticity of demand for each unit increases.

If the price of film increases, the demand for film processing would decrease; moreover, the equilibrium price and quantity of film processing should also decrease

a. True b. False

Economics

What will be an ideal response?