The difference between personal income and disposable personal income is that

A. personal income taxes are not included in disposable personal income.

B. disposable personal income includes only the funds available to spend on non-necessities.

C. personal income does not include transfer payments, such as Social Security payments or welfare payments and disposable personal income includes them.

D. personal income includes personal income taxes and indirect business taxes, which are not included in disposable personal income.

Answer: A

You might also like to view...

How can lack of investment in social capital affect private firms' profits?

What will be an ideal response?

Refer to Figure 3-4. If the current market price is $15, the market will achieve equilibrium by

A) a price increase, increasing the quantity supplied and decreasing the quantity demanded. B) a price decrease, decreasing the supply and increasing the demand. C) a price decrease, decreasing the quantity supplied and increasing the quantity demanded. D) a price increase, increasing the supply and decreasing the demand.

A movement along the supply curve might be caused by a change in

a. production technology. b. input prices. c. expectations about future prices. d. the price of the good or service that is being supplied.

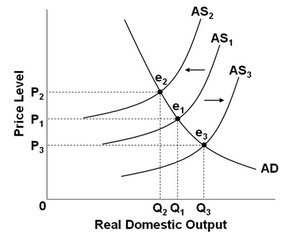

Refer to the above diagram. If aggregate supply shifts from AS1 to AS2, then the price level will:

Refer to the above diagram. If aggregate supply shifts from AS1 to AS2, then the price level will:

A. increase and real domestic output will decrease. B. decrease and real domestic output will decrease. C. decrease and real domestic output will increase. D. increase and real domestic output will increase.