According to the Laffer curve, when the tax rate is 100 percent, tax revenue will be:

A. 0.

B. at the maximum value.

C. the same as it would be at a 50 percent tax rate.

D. greater than it would be at a 50 percent tax rate.

Answer: A

You might also like to view...

The Fed tends not to use discount policy as its principal tool in influencing the money supply since

A) discount loans do not affect the money supply. B) it does not have as much control over discount loans as it has on open market operations. C) it is prohibited from doing so by an act of Congress. D) it prefers to use reserve requirements.

Assume that the multiplier effect for Mexico is 0.85 for an increase in spending by the U.S. government by $1 . Therefore, a $20 billion decrease in spending by the U.S. government results in:

a. a $23.5 billion increase in Mexican real GDP. b. a $133.3 billion decrease in Mexican real GDP. c. a $3 billion decrease in Mexican real GDP. d. a $17 billion decrease in Mexican real GDP. e. a $23.5 billion decrease in Mexican real GDP.

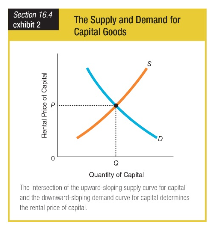

What do these supply and demand curves indicate about the supply of capital?

a. Supply is increased at prices above the equilibrium.

b. Price does not affect capital supply or demand.

c. The supply curve shifts right when demand rises.

d. Equilibrium rent is below marginal revenue product.

The main reason for our balance of payments deficits has been

A. military spending abroad. B. spending by U.S. tourists abroad. C. our negative balance of trade. D. None of these choices are correct.