The federal tax on cigarettes is

A. direct and regressive.

B. direct and progressive.

C. indirect and regressive.

D. indirect and progressive.

C. indirect and regressive.

You might also like to view...

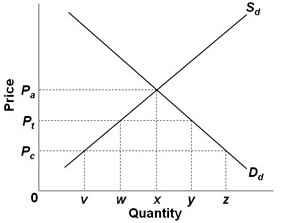

Use the following graph, where Sd and Dd are the domestic supply and demand for a product and Pc is the world price of that product, to answer the next question. With a Pt?Pc per-unit tariff, the quantities sold by foreign and domestic producers respectively will be

With a Pt?Pc per-unit tariff, the quantities sold by foreign and domestic producers respectively will be

A. y?w and w. B. z?x and x. C. x?v and x. D. z?w and x.

Suppose the government imposes a $1 tax on frisbees, and the price of a frisbee paid by demanders rises by $1

A) The price rise is consistent with a perfectly elastic supply for frisbees. B) The price rise is consistent with a perfectly elastic demand for frisbees. C) The price rise is consistent with a downward-sloping supply curve for frisbees. D) The price could never rise this much, so this situation cannot happen.

The additional benefit to a consumer from consuming one more unit of a good or service

A) is equal to economic surplus. B) is equal to marginal benefit. C) is equal to the opportunity cost of consuming the good or service. D) is equal to consumer surplus.

Which is the least common type of business?

A) sole proprietorship B) corporation C) partnership D) impossible to determine without further information