Kroll, Inc., manufactures and sells two products: Product A4 and Product T6. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Expected Production Direct Labor-Hours Per Unit Total Direct Labor-HoursProduct A4800 7.0 5,600 Product T6300 9.0 2,700 Total direct labor-hours 8,300 The direct labor rate is $21.50 per DLH. The direct materials cost per unit is $212.40 for Product A4 and $295.50 for Product T6.The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:Activity Cost PoolsActivity MeasuresEstimated Overhead CostExpected Activity???Product A4Product

T6TotalLabor-relatedDLHs$402,550 5,6002,7008,300Production ordersorders 61,705 400300700Order sizeMHs 656,110 3,6003,4007,000 $1,120,365 The unit product cost of Product A4 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to: (Round your intermediate calculations to 2 decimal places.)

A. $979.95 per unit

B. $1,019.01 per unit

C. $1,307.76 per unit

D. $702.40 per unit

Answer: C

You might also like to view...

The ABC inventory classification approach is used for?

a. Dependent demand inventory b. Independent demand inventory c. Both dependent and independent demand inventory d. Neither dependent nor independent demand inventory

On May 1, 2010, Cynthia Hendrix bought her home and First Bank recorded its mortgage. On June 24, 2012, Cynthia sold her home to Stanton Gulbrandsen for $250,000. At that time, Cynthia's mortgage was $225,000. Stanton assumed Cynthia's mortgage and gave Second Bank a second mortgage for $225,000. Second Bank did not record its mortgage. On October 12, 2014, Stanton sold the home to Derek Bolger

for $275,000. Bolger took the property subject to the previous mortgages and executed a $275,000 mortgage to Third Bank. Third Bank recorded its mortgage on October 18, 2014. Third Bank knew of the Second Bank mortgage. Assume Derek defaults on his loan, if the property is sold for $200,000 and the mortgage balances are as follows, how much does First Bank get?? First - $215,000 Second - $200,000 Third - $272,000 A)?$200,000 B)?$195,000 C)?One-third of $200,000 D)?One-half of $200,000 because Second Bank didn't record

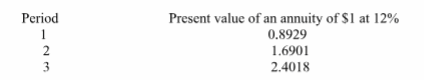

What is the net present value of this machine assuming all cash flows occur at year-end?

A company is considering the purchase of new equipment for $45,000. The projected

annual net cash flows are $19,000. The machine has a useful life of 3 years and no salvage

value. Management of the company requires a 12% return on investment. The present value of

an annuity of $1 for various periods follows:

A) $(1,768)

B) $3,000

C) $634

D) $19,000

E) $45,634

Leadership behavior is described as either task-oriented, relationship-oriented, passive, or____________

a. powerful b. gendered c. transformational d. situational