Bonds are issued with either a face value or a maturity date, but not both.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Considering all costs of production, the marginal cost of producing a hot dog is $1.00. The price of a hot dog is $1.50. Thus, the producer surplus from this hot dog is

A) $1.50. B) $1.00. C) $.50. D) Zero, because $1.50 is the most anyone would pay for a hot dog.

In the long run, if the money supply increases: a. most of the resulting rise in nominal GDP will be a result of increases in the exchange rate. b. most of the resulting rise in nominal GDP will be a result of increases in the price level. c. most of the resulting rise in real GDP will be a result of increases in the price level

d. most of the resulting rise in real GDP will be a result of increases in the interest rate. e. most of the resulting rise in real GDP will be a result of increases in aggregate expenditure.

Suppose all people have the same age-earnings profile and the percent of the population in each age category is the same. The distribution of income at any point in time will be

A. equal because incomes and wealth levels must then be the same. B. unequal because incomes differ by age. C. equal because all have the same profile. D. unequal because other sources of income will differ.

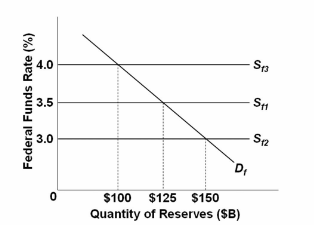

Refer to the diagram for the federal funds market. If the federal funds rate rose from 3.5 percent to 4.0 percent, which of the following is the most likely explanation?

A. The Fed sold bonds to banks.

B. The Fed bought bonds from banks.

C. The demand for federal funds fell.

D. The Fed raised the prime interest rate.