The third largest source of government tax revenues that contributes roughly 10 percent to total revenues is:

A. payroll tax.

B. personal income tax.

C. corporate income tax.

D. excise tax.

C. corporate income tax.

You might also like to view...

Which statement is true?

A. Productive efficiency has never been achieved. B. The U.S. economy achieved productive efficiency from mid-1997 through mid-2001. C. The U.S. economy achieved productive efficiency from 1980 to 1997. D. The U.S. economy generally attains productive efficiency.

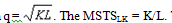

A firm has the production function  . The wage rate is $10 per unit of labor and the rental rate is $5 per unit of capital and the firm is going to spend $1000 on production.

. The wage rate is $10 per unit of labor and the rental rate is $5 per unit of capital and the firm is going to spend $1000 on production.

i. Assuming that the firm is free to choose any level of K and L to emply, how much of each should it emply? How much output will they produce? ii. Now assume that once the firm has chosen its level of L and K, the level of K becomes fixed. If the price of K increases to $8 per unit, how many units of output can the firm now produce if it spends the same amount? iii. Once the firm reaches the long run again and is able to vary its level of K, how much should L and K should it employ in order to achieve its original level of output? How much will that level of production cost?

Sam has two jobs, one for the winter and one for the summer. In the winter, he works as a lift attendant at a ski resort where he earns $13 per hour. During the summer, he drives a tour bus around the ski resort, earning $11 per hour. During the winter months, what is Sam's opportunity cost of taking an hour off work to go skiing?

a. $13 b. between $11 and $12 c. $11 d. less than $11

As the number of firms in an oligopoly grows, the industry approaches a level of output ________ the competitive level and ________ the monopoly level.

a. more than, less than b. less than, equal to c. less than, more than d. equal to, more than