The net present value of $1,000 received one year from now will

a. increase with the interest rate.

b. exceed $1,000 as long as the interest rate is positive.

c. exceed the net present value of $1,000 to be received two years from now.

d. equal $1,100 if the current interest (discount) rate is 10 percent.

C

You might also like to view...

Which of the following statements is false?

A) Trade-offs do not apply when the consumers purchase a product for which there is excess supply, such as a stock clearance sale. B) Anytime you have to decide which action to take you are facing an economic trade-off. C) Economics is a social science that studies the trade-offs we are forced to make because of scarcity. D) Every individual, no matter how rich or poor, is faced with making trade-offs.

The income velocity of money is the absolute number of times, on average, that

A) people purchase goods and services during a year. B) each monetary unit is spent on final goods and services. C) each unit of real GDP is produced by business firms. D) each one-unit increase in the price level occurs.

Since 2002, the Fed has shifted to expansionary monetary policy, then to restrictive policy, and then back to expansionary monetary policy. Policy shifts of this type are most likely to

a. promote economic stability and stimulate employment. b. keep the general level of prices relatively stable because the periods of restrictive policy will just offset the periods of expansion. c. help promote economic stability because changes in monetary policy can be counted on to exert a predictable impact on the economy quickly. d. promote instability because the time lags of monetary policy are long and variable.

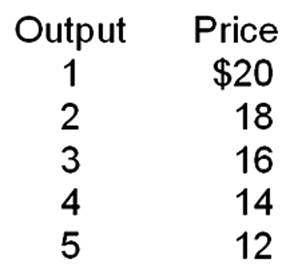

The marginal revenue that would be derived from the production of the fifth unit is

A. $20.

B. $16.

C. $12.

D. $4.