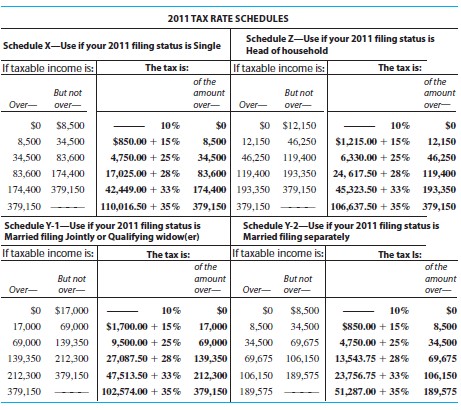

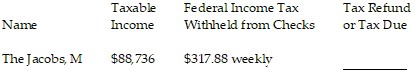

Find the amount of any refund or tax due. The letter following the name indicates marital status. Assume a 52-week year and that married people are filing jointly. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people, and $8500 for head of household; and the tax rate schedule.

A. $10,619.44 refund

B. $2095.76 due

C. $10,619.44 due

D. $2095.76 refund

Answer: D

Mathematics

You might also like to view...

Solve. = -1

= -1

A. 3 B. 1 C. -1 D. No solution

Mathematics

Solve using the addition principle.m - 4 = -1

A. -3 B. 3 C. -5 D. 5

Mathematics

Evaluate.-63

A. -36 B. -216 C. 216 D. 1,296

Mathematics

Solve the system by the elimination method.2x + 6y = -5-10x - 30y = 25

A. {(3, -5)} B. ? C. {(2, 3)} D. {(x, y)| 2x + 6y = -5}

Mathematics