Suppose that two firms in an industry with a Herfindahl index of 5,000 announce a merger. The U.S. Justice Department concludes the merger will boost the index to 5,500. The antitrust authorities will most likely:

A. ignore this merger because of the relatively small increase in the Herfindahl index.

B. allow the merger but watch the new firm carefully for future violations of the antitrust laws.

C. allow the merger if foreign entry to the industry is possible.

D. prevent the merger, contending that it violates the Clayton Act.

Answer: D

You might also like to view...

Over a business cycle, the quantities of capital, human capital, and entrepreneurial talent

A) change gradually and do not fluctuate much. B) cycle alongside real GDP. C) are completely unpredictable and cannot be forecast. D) cycle more than real GDP. E) are constant and do not change.

Many developing countries make the government budget one of the primary tools of long-run industrial development, with the government owning and operating industries such as steel mills, airlines, and phone companies

Indicate whether the statement is true or false

Diamonds are expensive because:

A. very few diamonds are discovered each year. B. the seller of most diamonds in the world restricts output. C. they are a symbol of luxury. D. they are a form of conspicuous consumption.

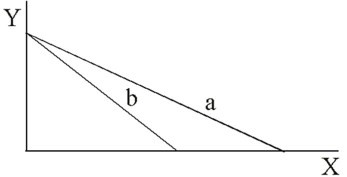

Which is true of the two budget lines drawn below?

A. The absolute price of good Y is greater with budget line a than with budget line b. B. Line b and line a have the same nominal income. C. Line a has a higher nominal income than line b. D. The price of good X is larger with budget line a.