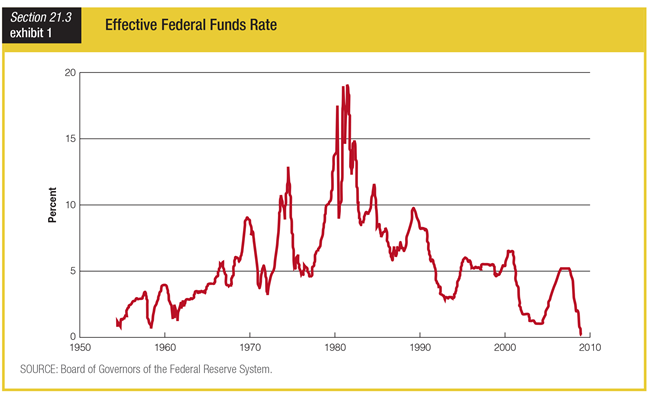

Based on the graph showing the effective federal funds rate, in what context did the downturn in interest rates after the 2001 recession occur?

a. Interest rates were higher than they were at the start of previous downturns.

b. Interest rates were lower than they were at the start of previous downturns.

c. Interest rates were at an all-time low before the start of the downturn.

d. Interest rates were at an all-time high before the start of the downturn.

b. Interest rates were lower than they were at the start of previous downturns.

You might also like to view...

If a firm is earning just enough to cover all its economic profits does that mean it's not making a profit?

What will be an ideal response?

Mike wants to open his own repair shop, and is considering using his savings of $30,000 to get it started. He is currently earning 3 percent interest on his savings. His friend Bob calls him and asks to borrow $30,000 to start up a bagel shop; Bob offers to pay him 5 percent interest if he loans him the money. If Mike were to use the money to open his own repair shop, how can he accurately account for his costs?

A. Mike must consider the $900 in forgone interest on his savings as an implicit cost. B. Mike must consider the $1,500 in forgone interest from loaning the money to Bob as an implicit cost. C. Mike must consider the $900 in forgone interest on his savings as an explicit cost. D. Mike must consider the $1,500 in forgone interest from loaning the money to Bob as an explicit cost.

If a dollar is more expensive in terms of a foreign currency than the equilibrium exchange rate, a ____ exists at the current exchange rate that will put ____ pressure on the exchange value of a dollar

a. surplus of dollars; downward b. surplus of dollars; upward c. shortage of dollars; downward d. shortage of dollars; upward

When analyzing the impact of government consumption and taxes in an open economy, we exclude transfer payments because:

a. they are not paid for by taxes. b. in the aggregate, they do not generate a change in total spending on goods and services. c. the sums are so large as to be incalculable. d. the sums are so small as to be insignificant.