Draw a Laffer Curve and explain the relationship it purports to portray. Why might this curve be important for macroeconomic policy?

What will be an ideal response?

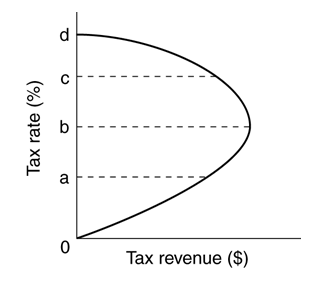

The following curve suggests that up to point b higher tax rates will result in larger tax revenues, but beyond that any increase in rates will have adverse effects on incentives, result in tax avoidance or tax evasion, and generally reduce overall tax revenues. The curve is important for macroeconomic policy because it correctly suggests that there is an upper limit to tax rates in terms of their potential to increase revenue. Beyond the limit, higher rates will not raise revenues, but will lower them. Laffer was suggesting that the government had already reached the limit and that by lowering rates the government could increase revenue. That is the point of debate. There is little evidence to suggest what the upper limit on tax rates might be in terms of their revenue-raising potential. See graph.

You might also like to view...

The multiplier helps explain

A) why a decrease in taxes causes real Gross Domestic Product (GDP) to fall by more than the amount of the decrease in taxes. B) why an increase in disposable income causes real Gross Domestic Product (GDP) to rise by less than the amount of the increase in disposable income. C) why a rise in government expenditures causes real Gross Domestic Product (GDP) to rise by more than the amount of the increase in government spending. D) why a fall in investment cause real Gross Domestic Product (GDP) to rise by more than the amount of the decrease in investment.

If inflation is completely anticipated,

A) lenders lose in the economy. B) borrowers lose in the economy. C) firms lose because they incur menu costs. D) no one loses in the economy.

In 2009, Congress passed a bill that involved government spending increases and tax cuts with the purpose of stimulating the U.S. economy. This policy is an example of

A) an automatic stabilizer. B) contractionary fiscal policy. C) expansionary fiscal policy. D) expansionary monetary policy.

A constant-cost industry is one that can expand and contract without effecting per unit production costs

a. True b. False