Public goods are nonrival in consumption and nonexclusive, so private firms cannot sell them profitably

Indicate whether the statement is true or false

true

You might also like to view...

"The plan to create private accounts in Social Security will reduce benefits for some workers," is an example of a ________ statement, while "Social Security will be better if the private accounts are allowed" is an example of a ________ statement.

A. structural policy; fiscal policy B. normative; positive C. positive; normative D. monetary policy; fiscal policy

f the price of hairbrushes decreases by 20 percent, the quantity demanded increases by 2 percent. The price elasticity of demand is:

A. 0.1, and is elastic. B. 10 and is elastic. C. 0.1 and is inelastic. D. 10 and is inelastic.

Which of the following statements about taxes and government spending is correct?

A. Despite the overall progressive tax system, government expenditures disproportionately favor the rich and result in a system that is slightly regressive. B. The progressive tax system is almost perfectly offset by regressive expenditures, making the overall system proportional. C. The regressive tax system is offset by expenditures directed toward lower-income households, making the overall system proportional. D. The overall system of taxes and spending is progressive, as over $1 trillion per year gets transferred from upper-income households to lower- and middle-income households.

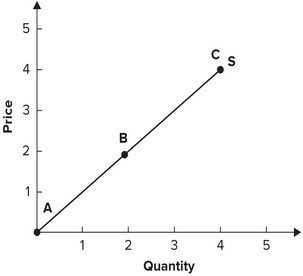

Refer to the following graph. Elasticity is greatest at point:

Elasticity is greatest at point:

A. A. B. B. C. C. D. It is the same everywhere along this supply curve.