Kingston Specialty Corporation manufactures joint products P and Q. During a recent period, joint costs amounted to $80,000 in the production of 20,000 gallons of P and 60,000 gallons of Q. Kingston can sell P and Q at split-off for $2.20 per gallon and $2.60 per gallon, respectively. Alternatively, both products can be processed beyond the split-off point, as follows: PQSeparable processing costs$15,000 $35,000 Sales price (per gallon) if processed beyond split-off$3 $4 The joint cost allocated to Q under the relative-sales-value method would be:

A. $64,000.

B. $40,000.

C. $62,400.

D. $65,600.

E. None of the answers is correct.

Answer: C

You might also like to view...

Answer the following statements true (T) or false (F)

1. The recent structural trend is toward a taller organizational hierarchy. 2. Sabotage can be a form of resistance to change in the workplace. 3. Mistrust between change agents and employees can cause failure of well-conceived changes. 4. Innovative change is the least threatening type of change and is therefore least likely to create resistance.

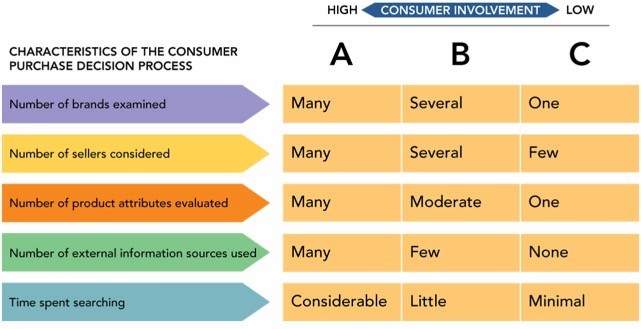

Figure 4-3In Figure 4-3 above, column A represents which of the following in terms of consumer involvement and product knowledge?

Figure 4-3In Figure 4-3 above, column A represents which of the following in terms of consumer involvement and product knowledge?

A. integrated problem solving B. extended problem solving C. consideration set D. limited problem solving E. routine problem solving

Subsidies that confer a benefit may well evoke countervailing duties.

Answer the following statement true (T) or false (F)

Total fixed costs vary inversely with levels of production

Indicate whether the statement is true or false