Solve the problem.Andrew earns a gross weekly income of $561.41. How much Social Security tax should be withheld the first week of the year? How much Medicare tax should be withheld? Social security tax is 6.2% and Medicare tax is 1.45%. Round to the nearest cent.

A. Social Security tax = $34.81

Medicare tax = $8.14

B. Social Security tax = $3.48

Medicare tax = $0.81

C. Social Security tax = $35.81

Medicare tax = $9.14

D. Social Security tax = $348.10

Medicare tax = $81.40

Answer: A

Mathematics

You might also like to view...

Multiply.36(-5.08)

A. 41.18 B. 30.92 C. 41.08 D. -182.88

Mathematics

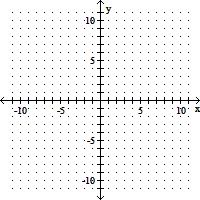

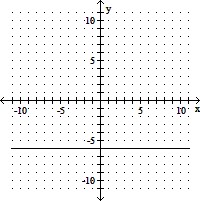

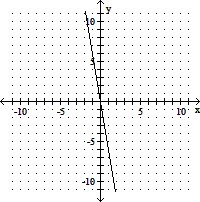

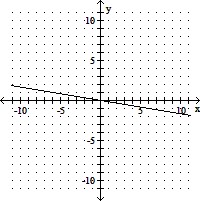

Graph the equation.x = -6

A.

B.

C.

D.

Mathematics

Decide whether or not the set of ordered pairs defines a function.{(-8, -8), (-3, 8), (-2, -8), (2, -5)}

A. Yes B. No

Mathematics

Use the method of your choice to find all real solutions of the equation.2x2 + 12x = - 7

A.

B.

C.

D.

Mathematics