Isabel purchases a $1,000 face value one-year Treasury bill for $934.58, and the next day investors decide they will only buy one-year Treasury bills if they receive an interest rate of 9%

If Isabel decides to sell her Treasury bill to another investor the day after she purchased it, she will A) receive a capital gain of $28.04.

B) receive a capital gain of $7.76.

C) suffer a capital loss of $18.69.

D) suffer a capital loss of $17.15.

D

You might also like to view...

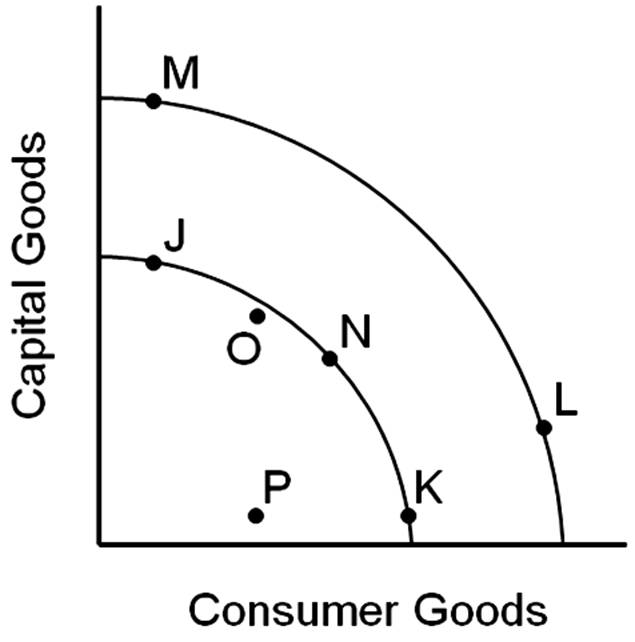

Assuming the inner curve is the United States' current production possibilities frontier, which of the following points would eventually lead to the greatest level of economic growth?

A. Point J

B. Point N

C. Point K

D. Point P

The marginal propensity to consume (MPC) is equal to

A) 1 + MPS. B) 1 - MPS. C) MPS + 1. D) MPS - 1.

Using the above figure, at which price is there neither excess quantity demanded nor excess quantity supplied?

A) P1 B) P2 C) P3 D) none of these

The _____________ tells us when the government raises taxes, it gets more revenue per unit sold.

A. quantity effect B. income effect C. price effect D. substitution effect