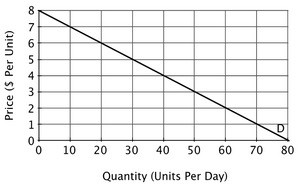

Suppose Grandis and Immanis are the only two companies that sell the product whose market demand curve is shown in the accompanying figure. For both companies, both average total cost and marginal cost are constant and equal to $2 (ATC = MC = $2). Suppose Grandis and Immanis agree to collude by both charging the price a monopolist would charge and each producing half of the monopolist's profit-maximizing level of output. Grandis, however, decides to cheat on the collusive agreement. If Grandis charges $1 less than the monopoly price while Immanis continues to charge the monopoly price, then Grandis will earn a profit of ________ per day.

Suppose Grandis and Immanis agree to collude by both charging the price a monopolist would charge and each producing half of the monopolist's profit-maximizing level of output. Grandis, however, decides to cheat on the collusive agreement. If Grandis charges $1 less than the monopoly price while Immanis continues to charge the monopoly price, then Grandis will earn a profit of ________ per day.

A. $20

B. $40

C. $160

D. $80

Answer: D

You might also like to view...

Suppose prices of personal computers fall significantly and consumers respond by buying more personal computers. The consumer price index

a. reflects this price decrease accurately. b. understates this price decrease due to the substitution bias. c. overstates this price decrease due to the income bias. d. overstates this price decrease due to the substitution bias.

Suppose that when the price of oranges is $3 per pound, the quantity demanded is 4.7 tons per day and the quantity supplied is 3.9 tons. In this case:

A. excess supply will lead the price of oranges to rise. B. excess supply will lead the price of oranges to fall. C. excess demand will lead the price of oranges to fall. D. excess demand will lead the price of oranges to rise.

Which of the following is NOT a step involved in optimization using total value?

A) Calculating the total net benefit of each alternative B) Choosing the alternative with the highest net benefit C) Converting all costs and benefits into a common value of measurement D) Calculating the marginal consequences of moving between alternatives

Keynes explained that recessions and depressions occur because of

a. excess aggregate demand.

b. inadequate aggregate demand.

c. excess aggregate supply.

d. inadequate aggregate supply.