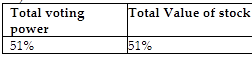

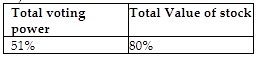

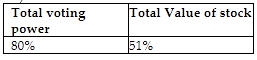

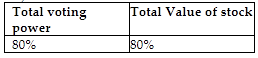

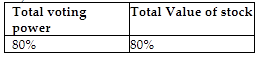

Diana Corporation owns stock of Tomika Corporation. For Diana and Tomika to qualify for the filing of consolidated returns, at least what percentage of Tomika's total voting power and total value of stock must be directly owned by Diana?

A)

B)

C)

D)

D)

You might also like to view...

Adjusting entries are journalized and posted after closing entries

Indicate whether the statement is true or false

Which of the following is true for an auction with reserve?

A) The seller retains the right to refuse the highest bidder. B) Invitations to make an offer are not allowed. C) Goods cannot be withdrawn from sale after the offer has been made. D) A bid once made cannot be withdrawn and is legally binding.

The FDA labels ordinary household soap as a cosmetic product

Indicate whether the statement is true or false

Alicia has a tax credit of $100 and a marginal tax rate of 28%. Alicia's income tax will be reduced by how much as a result of the credit?

A) $28 B) $128 C) $100 D) None of the above; her taxes will increase by $100.