Athletic Accessories has the following transactions related to investments in common stock. May 1Purchases 5,000 shares (insignificant influence) of Endurance Wear ?common stock for $22 per share. June 30Receives a cash dividend of $1 per share.October 18Sells 2,000 shares of Endurance Wear common stock at $25 per share.December 31Adjusts the investments to fair value. The fair value of Endurance Wear ?common stock is now $30 per share.1.Record each of these transactions, including an entry on December 31 to adjust the investment to fair value. 2.Calculate the balance of the investment account on December 31.

What will be an ideal response?

May 1

| Investments | 110,000 | ? |

| Cash | ? | 110,000 |

($22 × 5,000 shares)

June 30

| Cash | 5,000 | ? |

| Dividend revenue | ? | 5,000 |

($1 × 5,000 shares)

October 18

| Cash ($25 × 2,000 shares) | 50,000 | ? |

| Investments ($22 × 2,000 shares) | ? | 44,000 |

| Gain (difference) | ? | 6,000 |

December 31

| Investments | 24,000 | ? |

| Unrealized Holding Gain-Net Income | ? | 24,000 |

($8 × 3,000 shares)

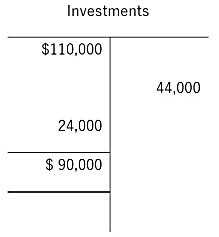

The balance in the Investments account on December 31 is $90,000, equal to the 3,000 remaining shares times $30 per share fair value. The balance in the Investments account can be verified by posting all transactions to a T-account.

You might also like to view...

Which of the following products is most likely to be produced in a process operation?

A. Custom cabinets B. Designer bridal gowns C. Bridges D. Cereal E. Airplanes

The high/low pricing strategy helps sell slow-moving merchandise.

Answer the following statement true (T) or false (F)

Collini Corporation has two production departments, Machining and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: MachiningCustomizingMachine-hours 17,000 15,000Direct labor-hours 3,000 6,000Total fixed manufacturing overhead cost$102,000$61,200Variable manufacturing overhead per machine-hour$1.70 Variable manufacturing overhead per direct labor-hour $4.10 During the current month the company started and finished Job T268. The following

data were recorded for this job: Job T268:MachiningCustomizingMachine-hours 80 30Direct labor-hours 30 50Direct materials$720$380Direct labor cost$900$1,500The total amount of overhead applied in both departments to Job T268 is closest to: A. $715 B. $2,046 C. $616 D. $1,331

Westland, Inc. owns a delivery truck. Which of the following costs, associated with the truck, will be treated as a revenue expenditure?

A) oil change and lubrication B) major engine overhaul C) modification for new use D) addition to storage capacity