Explain why deflation can be so troubling to borrowers and lenders.

What will be an ideal response?

Deflation is troubling because it aggravates the problem of obtaining accurate information. During periods of deflation companies find that their liabilities are fixed in nominal dollars that are not declining, yet the value of their assets are going to decline and the revenue from the products they sell may also decline. This places greater burden on servicing debt, but perhaps more importantly from an information perspective, it makes the determination of actual net worth more difficult. If a lender cannot determine the actual net worth of a borrower the likelihood of the borrower obtaining a loan is decreased.

You might also like to view...

Implicit costs refer to

a. out-of-pocket expenses b. all readily identified expenditures c. incremental costs of policy d. none of the above

Antitrust enforcement of vertical relationships is generally focused on

a. The dominant firm using horizontal contracts to extend market power to other levels of the supply chain b. Vertical contracts increasing the intensity of competition c. Vertical contracts that harm consumers d. All of the above

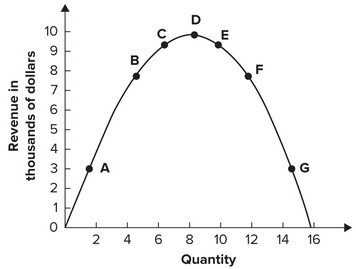

Refer to the graph shown. Between points E and F demand is:

A. elastic. B. inelastic. C. unit elastic. D. perfectly elastic.

Since the 1980s the proportion of income received by the top 5 percent of Americans has ____, and the measured income of Americans in the lowest fifth has ____

a. risen; risen b. risen; fallen c. fallen; risen d. fallen; fallen