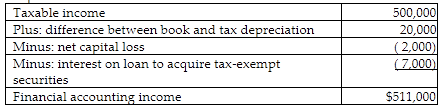

What is Winter's financial accounting income?

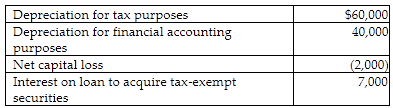

Winter Corporation's taxable income is $500,000. In addition, Winter has the following items:

A) $511,000

B) $513,000

C) $518,000

D) $520,000

A) $511,000

You might also like to view...

Which of the following is NOT a marketing field?

A) supply-channel management B) accounting C) brand management D) advertising E) new product planning

According to your text, the primary reason firms rely on inventory management is

A. to be able to forecast future production runs of a product. B. so that customer service won't suffer from lack of product in any given location. C. to facilitate the movement of product from the warehouse to the end-customer. D. so they can predict how much product to manufacture at the lowest cost. E. to avoid an abundance of stock sitting in a warehouse.

Ramos Corporation reported the following equity section on its current balance sheet

The common stock is currently selling for $18.00 per share. Common Stock, $5 par, 194,000 shares authorized, 143,000 shares issued and outstanding $715,000 Paid-In Capital in Excess of Par-Common 130,000 Retained Earnings 301,000 Total Stockholders' Equity $1,146,000 After the declaration and distribution of a 20% stock dividend, what is the total number of common shares issued? A) 13,000 B) 160,160 C) 143,000 D) 17,160

Violators of the Sherman Act face the possibility of being sent to prison for violating that law

a. True b. False Indicate whether the statement is true or false