Which of the following statements about implicit and explicit taxes is false?

A. The taxpayer pays an explicit tax to the taxing jurisdiction.

B. The amount of implicit tax on an investment depends on the owner's marginal tax rate.

C. An investment yielding ordinary income taxed at the regular tax rates should not have an implicit tax.

D. None of the above is false.

Answer: B

You might also like to view...

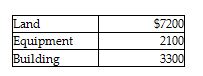

Anderson Company has purchased a group of assets for $23,800. The assets and their relative market values are listed below.

Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $4200

B) $13,566

C) $4046

D) $6188

Which of the following is one of Holiday Inn's hotel areas that show a particularly strong impact on revenue per available room?

a. Dining facilities b. The lobby c. The exterior d. Public restrooms e. Kitchen facilities

Toys R Us and the Foot Locker are examples of:

a. department stores b. discount stores c. hypermarkets d. catalog showrooms e. specialty stores

Mary tells her accountant, "I must have this year's audit completed by March 1, and time is of the essence." The accountant agrees to complete the audit by March 1 . Under general contract law, if the audit is not completed by March 1, Mary does not have to pay the accountant for the audit

a. True b. False Indicate whether the statement is true or false