A tax for which the average tax rate rises with income is defined as a

a. regressive tax.

b. proportional tax.

c. neutral tax.

d. progressive tax.

D

You might also like to view...

Using a credit card can best be likened to

A) taking out a loan. B) a barter exchange. C) using currency only as a means of payment. D) using any other form of money as a means of payment.

When Jane Brown writes a $100 check to her nephew and he cashes the check, Ms. Brown's bank ________ assets of $100 and ________ liabilities of $100

A) gains; gains B) gains; loses C) loses; gains D) loses; loses

Each nation's International Monetary Fund (IMF) quota subscription is based on

A) its national income. B) its share in world trade. C) its public debt. D) its trade surplus.

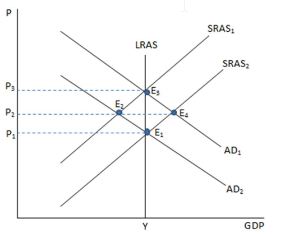

If the economy is in a recession, which point in the graph shown would likely represent this?

A. E1

B. E2

C. E3

D. E4