A futures contract

A) gives the owner the right, but not the obligation, to buy shares of a stock at a specified price within the time limits of the contract.

B) gives the owner the right, but not the obligation, to sell shares of a stock at a specified price within the time limits of the contract.

C) is a contract in which the seller agrees to provide a particular good to the buyer on a specified future date at an agreed-upon price.

D) gives the owner the right, but not the obligation, to buy or sell shares of a stock at a specified price within the time limits of the contract.

C

You might also like to view...

If a firm buys its labor in a competitive market, then a short-run increase in the price of the firm's output will cause the firm to

A) offer a higher wage. B) hire fewer workers. C) hire more workers. D) offer a lower wage.

If the price elasticity of demand for a product measures .45,

a. this good has many available substitutes. b. this good must be a nonessential good. c. this good is a high-priced good. d. a decrease in price will increase total revenue. e. this good is demand price inelastic.

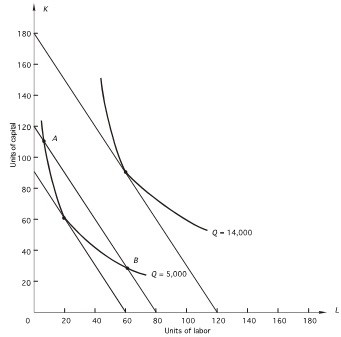

Refer to the following graph. The price of capital (r) is $20. What combination of labor (L) and capital (K) can produce 5,000 units of output at lowest cost?

What combination of labor (L) and capital (K) can produce 5,000 units of output at lowest cost?

A. 60K, 20L B. 110K, 10L C. 42K, 52L D. 10K, 110L E. 90K, 60L

The difference between net public debt and gross public debt is

A. all government interagency borrowing. B. the amount owed to individuals and firms outside the United States. C. the current year's budget deficit from the amount of public debt at the start of the year. D. the interest paid annually on the public debt.