Stocks appear to present risk, yet many people have substantial parts of their wealth invested in them. This behavior could be explained by:

A. investing in stocks over the long run is not as risky as short-term holdings of stocks

B. people are not very risk-averse and do not require a risk premium for stocks.

C. people are not efficient users of information.

D. people are irrational in their investment behavior, only focusing on positive outcomes.

Answer: A

You might also like to view...

Suppose there are 100 firms in an industry. If the leading firm has a 50 percent market share, the second largest firm has a market share of half the leader's, the third has a market share of half the second's, and the fourth largest has a market share of half the third's, what is the four-firm concentration ratio?

a. 6.25 percent b. 100.00 percent c. 75.50 percent d. 93.75 percent e. 99.75 percent

The branch of economics that studies the decisions made by individuals and firms is called macroeconomics

Indicate whether the statement is true or false

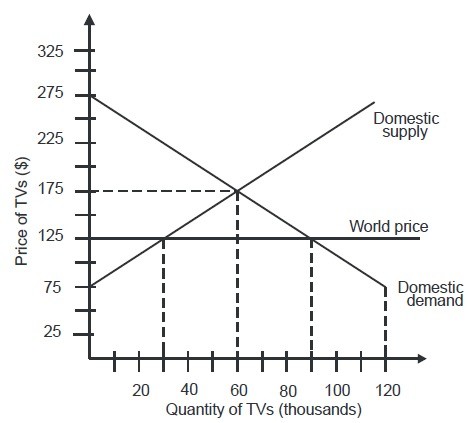

If this is a closed economy, the number of TVs exchanged will be ________.

A. 120,000 B. 90,000 C. 60,000 D. 30,000

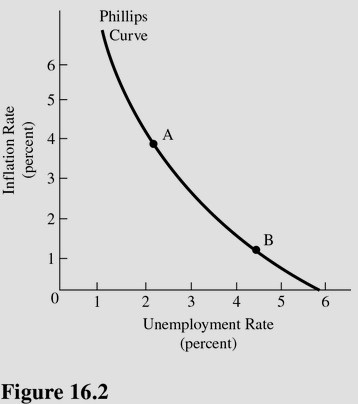

Refer to Figure 16.2. For the given Phillips curve, a decrease in aggregate demand, ceteris paribus, could cause a

Refer to Figure 16.2. For the given Phillips curve, a decrease in aggregate demand, ceteris paribus, could cause a

A. Rightward shift in the curve. B. Movement from point A to point B. C. Movement from point B to point A. D. Leftward shift in the curve.