If a firm sells to two distinct identifiable markets and resale is impossible, why is price discrimination more profitable than setting a single price?

What will be an ideal response?

If the firm charges a single price on the two different markets, marginal revenue in one market will exceed marginal revenue in the other. Without changing output level the firm could raise its profit as follows. The firm could sell one less unit in the low MR market and sell that unit in the higher MR market. As long as MRs differ, the firm can increase profit by changing sales in this direction. As this happens price is increasing in the market where sales are falling and price is falling in the market where sales are increasing.

You might also like to view...

In comparing one market basket, A, to others to the northwest or southeast, we can say that a typical consumer will

a. prefer A to any other market basket. b. prefer any other market basket to A. c. be indifferent between A and any other market basket. d. find any of the above are possible.

In the above, which figure(s) show(s) relationship between the variables that is always positive?

A) Figure A only B) Figures C and D C) Figures A and C D) Figures A, C, and D E) Figures A and B

Which of the following is an example of a fiscal policy?

A) The federal government increases income tax rates on people earning more than $250,000. B) The Federal Reserve takes action to greatly decrease the money supply. C) The Federal Reserve increases interest rates. D) Businesses begin to export and import more products and services.

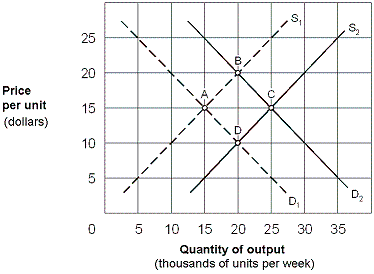

Exhibit 8-19 Long-run perfectly competitive industry

A. A to point B. B. B to point A. C. A to point D. D. A to point C.