Corporate profits are

A. taxed twice-once by the corporate tax system, and again by personal tax system when they are paid to stockholders as dividends.

B. taxed three times-once by the corporate tax system, again by the personal tax system, and again as capital gains.

C. taxed only when a stockholder sells his or her shares of stock.

D. taxed at too low a rate.

Answer: A

You might also like to view...

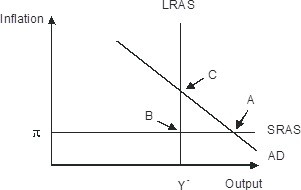

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________,

A. Rising; B; C B. Falling; A; C C. Falling; A; B D. Rising; A; C

In the past few centuries, choices have led to a substantial decline in the standards of living around the globe

Indicate whether the statement is true or false

When the Fed conducts an open market operation by purchasing securities from a bank, ________

A) public holdings of securities increase B) the bank's deposits increase but its reserves do not change C) the bank's deposits increase but its reserves decrease D) the bank's reserves increase

When a monopolistically competitive firm’s demand curve is tangent to it average cost curve,

A. the firm earns zero economic profit. B. new firms do not enter the market. C. the market is in long run equilibrium. D. All of these responses are correct.