What is the problem with marginal cost pricing in the natural monopoly situation? How do regulatory agencies in the United States usually handle the problem?

What will be an ideal response?

If the firm is a natural monopoly, then long-run average costs are downward sloping over the entire range of demand, which implies marginal cost lies below average cost. If price equals marginal cost, price will be below average cost and the firm will earn economic losses. In the long run, it will go out of business, so marginal cost pricing is not feasible. Most regulatory agencies strive for average cost pricing so that the owners receive a normal rate of return on investment.

You might also like to view...

The development of interchangeable parts by Eli Whitney and Simeon North allowed:

a. a. firms to better implement continuous-process manufacturing. b. producers to reduce production costs and increase supply. c. for easier and cheaper repair of damaged goods. d. All of the above.

One reason for the short-run aggregate supply curve (SRAS) is:

A. a fixed CPI market basket. B. perfect knowledge of workers. C. fixed-wage contracts. D. the upward-sloping production function.

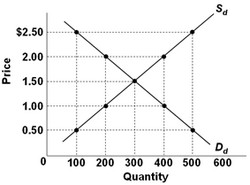

Use the following graph showing the domestic demand and supply curves for a specific product in a hypothetical nation called Marketopia to answer the next question. When the world price for this product is $0.50, Marketopia will

When the world price for this product is $0.50, Marketopia will

A. import 500 units. B. export 100 units. C. import 400 units. D. import 100 units.

Structural budget deficit is the hypothetical deficit we would have under current fiscal policies if the economy were operating near full employment.

Answer the following statement true (T) or false (F)