To produce financial stability, the Federal Reserve would want to

A. sell bonds during a recession and buy bonds during an economic boom.

B. raise the money supply and cut interest rates during a recession to stimulate spending.

C. increase the money supply during an economic boom and reduce the money supply during a recession.

D. raise the interest rate during a recession to prevent excessive borrowing and increase income for struggling banks.

Answer: B

You might also like to view...

A normal good is defined as a product for which quantity demanded increases as price decreases

a. True b. False

The most essential economic problem is the existence of: a. both an increasing population and the depletion of natural resources. b. both limited economic resources and unlimited desires

c. both inflation and unemployment. d. income inequality and economic freedom.

Fiscal policy moved toward expansion during the 1980s but toward restriction during the 1990s. How did these differences affect the economy?

a. The expansionary fiscal policy of the 1980s led to strong growth while the restrictive policy of the 1990s led to stagnation. b. The expansionary fiscal policy of the 1980s led to weaker growth than the restrictive policy of the 1990s. c. The expansionary fiscal policy of the 1980s generated more rapid growth than the restrictive policy of the 1990s. d. There is little evidence that the differences in fiscal policy between the two decades exerted much impact on either aggregate demand or real output.

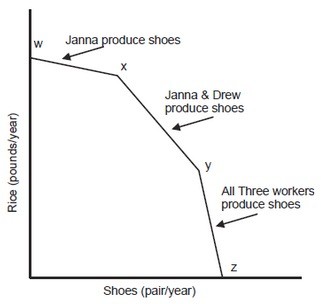

The following graph is the production possibility curve for a three-person economy, with workers Janna, Drew, and Kari.  Who has the greatest comparative advantage in shoe production?

Who has the greatest comparative advantage in shoe production?

A. Kari B. Janna C. Drew D. None of them