With the help of a suitable diagram, explain how in a two-country, two-commodity model one of the countries may fail to specialize completely despite enjoying comparative advantage in one of the goods.

What will be an ideal response?

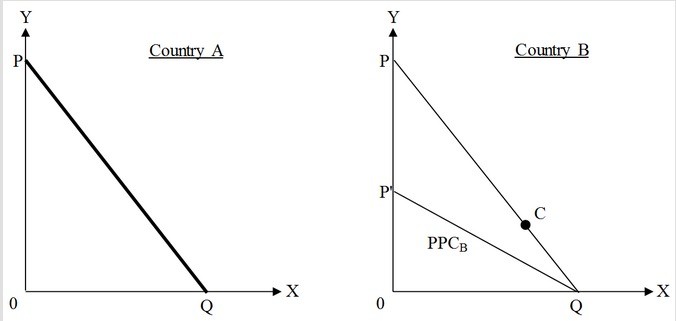

POSSIBLE RESPONSE: Let us consider a two-country, two-commodity model with constant opportunity costs. Here, one of the two trading countries may fail to specialize completely only in the special case in which the international price ratio coincides with the price ratio prevailing in that country in the absence of trade. In this case, the country whose price ratio does not change is a "large" country and the other country is a "small" country. The large country continues to produce both goods under free trade because the "small" country cannot export enough to satisfy the total demand for this product in the "large" country.

In this example Country A is the "large" country and Country B is the "small" country. PQ and P'Q are the production-possibility curves of Country A and Country B, respectively. Let the international trade line be PQ. From the graph, it is evident that Country A enjoys a comparative advantage in the production of Commodity Y and Country B enjoys the same in producing Commodity X. Since Country B is "small," it can completely specialize in Commodity X and can choose a consumption point on the international price ratio line or the trade line, say Point C. But for Country A, the trade line coincides with its PPC. This implies that there is no difference in its domestic price ratio and international price ratio. Country B is unable to export the amount needed to meet total domestic demand for Commodity X in Country A. So, Country A has to produce some of Commodity X for its own consumption, as well as producing Commodity Y and exporting some of its Commodity Y production to Country B. Therefore, in spite of having a comparative advantage in producing Commodity Y, Country A is unable to specialize completely.

You might also like to view...

The price elasticity of demand for labor will be smaller, the

A) smaller is the price elasticity of demand for the final product. B) easier it is to employ substitute inputs in production. C) larger is the proportion of wage costs in the total cost of production. D) longer is the time period under examination.

A rise in confidence is associated with higher consumption and investment demand, and leads to:

a. a downward shift in the AD curve. b. an inward shift in the AD curve. c. an outward shift in the AD curve. d. an upward shift in the AD curve.

The tolerance of bribe-taking by government officials

A. reduces the need for government to impose taxes on poor people. B. reduces government expenditures because public employees can be paid less. C. reduces economic efficiency because rules governing property rights are not regularly enforced. D. reduces economic uncertainty because all investors are aware of the practice.

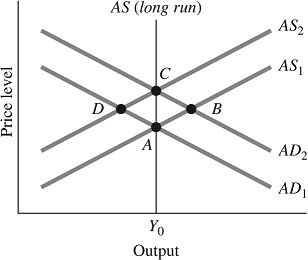

Refer to the information provided in Figure 32.3 below to answer the question(s) that follow. Figure 32.3Refer to Figure 32.3. Suppose the economy is at Point A. According to the new classical theory, an anticipated increase in aggregate demand

Figure 32.3Refer to Figure 32.3. Suppose the economy is at Point A. According to the new classical theory, an anticipated increase in aggregate demand

A. leaves the economy at Point A. B. moves the economy to Point B. C. moves the economy to Point C. D. moves the economy to Point D.