Initially a bank has a required reserve ratio of 20 percent and no excess reserves. If $5,000 is deposited into the bank, then initially, ceteris paribus,

A. Required reserves will increase by $5,000.

B. This bank can increase its loans by $5,000.

C. This bank can increase its loans by $4,000.

D. Total reserves will increase by $4,000.

Answer: C

You might also like to view...

This chapter explains that a firm that engages in second-degree price discrimination charges the same consumer different prices for different units of a good. You are a monopolist with many identical customers

Each will buy either zero, one, or two units of the good you produce. A consumer is willing to pay $50 for the first unit of this good and $20 for the second. You produce this good at a constant average and marginal cost of $5 . For simplicity, assume that if a consumer is indifferent between buying and not buying that he will buy. a. If you could not engage in second-degree price discrimination, what price would you charge? How much profit per customer would you earn? b. Suppose you offer your customers what seems to be a very generous deal: "Buy one at the regular price of $50, and get 60 percent off on a second." How many units of this good will each customer buy? How much profit per customer will you earn?

Who is affected when a Pigouvian subsidy is imposed on a market with a positive externality?

A. Producers B. Those affected by the externality C. Consumers D. All of these groups would be affected.

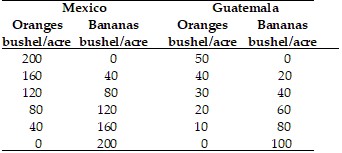

Refer to the information provided in Table 33.1 below to answer the question(s) that follow. Table 33.1 Refer to Table 33.1. The opportunity cost of producing a bushel of oranges in Mexico is

Refer to Table 33.1. The opportunity cost of producing a bushel of oranges in Mexico is

A. four times as much as that in Guatemala. B. twice as much as that in Guatemala. C. half as much as that in Guatemala. D. the same as that in Guatemala.

What is a balance-of-payments deficit?

What will be an ideal response?