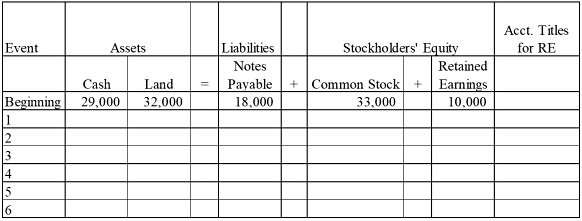

At the beginning of Year 2, the accounting records of Grace Company included the accounts and balances shown on the first row of the table below. During Year 2, the following transactions occurred:1. Received $95,000 cash for providing services to customers2. Paid salaries expense, $50,0003. Purchased land for $12,000 cash4. Paid $4,000 on note payable5. Paid operating expenses, $22,0006. Paid cash dividend, $2,500Required:a) Record the transactions in the appropriate accounts. Record the amounts of revenue, expense, and dividends in the retained earnings column. Enter 0 for items not affected. Provide appropriate titles for these accounts in the last column of the table. (The effects of the first event are shown below.)

alt="" style="vertical-align: 0.0px;" height="221" width="582" />b) What is the amount of total assets as of December 31, Year 2?c) What is the amount of total stockholders' equity as of December 31, Year 2?

What will be an ideal response?

a)

b) Total assets = $33,500 + $44,000 = $77,500

c) Total stockholders' equity = $33,000 + $30,500 = $63,500

You might also like to view...

The face rate is also called the nominal or stated rate

a. True b. False Indicate whether the statement is true or false

Socioeconomic and demographic characteristics used to categorize respondents are referred to as ________

A) basic information B) classification information C) problem-solving information D) identification information E) quantification information

Which of the following is an appropriate performance measure for a company whose corporate goal is to deliver quality products to its customers?

A. on-time delivery B. ability to respond to last-minute order changes C. proximity to the buyer’s premises D. delivery of defect-free products to the buyer

If a single taxpayer with a marginal tax rate of 24% has a long-term capital gain, it is taxed at

A. 25%. B. 15%. C. 20%. D. 0%.