A tax that takes a larger proportion of income from low-income groups than from high-income groups is a:

A. stabilizing tax.

B. regressive tax.

C. progressive tax.

D. proportional tax.

Answer: B

You might also like to view...

Refer to Figure 4-2. What area represents producer surplus at a price of P1?

A) A + C B) A + C + E C) C D) C + E

The inability of Congress to pass a stimulus package after September 11, 2001, could be used as an argument for

a. activist fiscal policy. b. activist monetary policy. c. expansionary fiscal policy. d. contractionary monetary policy.

Which of the following developments will most likely lead to an increase in the velocity of money?

a. a decrease in the expected inflation rate b. an increase in money interest rates c. a sharp decline in using credit cards d. a decrease in real income

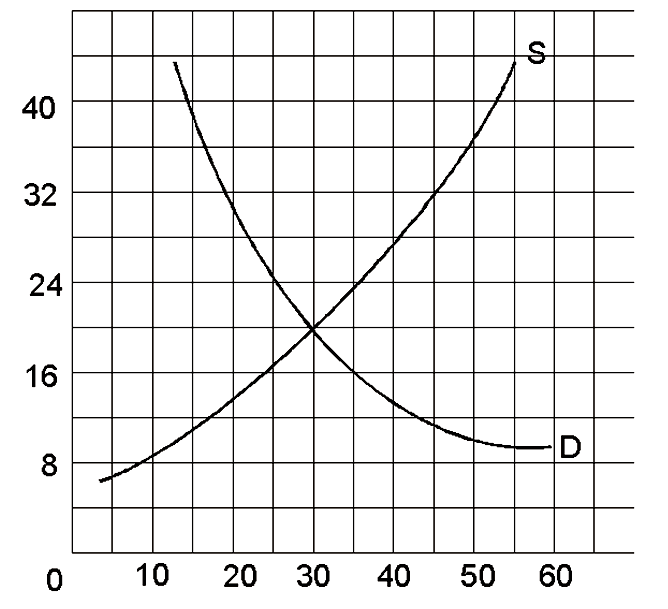

If the government set a price floor at $24

A. there would a temporary surplus, then prices would fall to equilibrium.

B. there would be a permanent surplus, at least until the price floor was lifted.

C. the price floor would not have any effect on this market.

D. the price would rise to the equilibrium price.