The federal budget was in deficit from 1931 to 1939, except in the year 1937. Given this fact, how do you explain E

Cary Brown's statement, "Fiscal policy, then, seems to have been an unsuccessful recovery device in the 'thirties-not because it did not work, but because it was not tried."

Economist E. Cary Brown is arguing that while the actual federal budget was mainly in deficit during the Great Depression, the cyclically adjusted federal budget was in surplus, except for one year. Cyclically adjusting the budget calculates what revenues and expenditures would have been, had the economy been producing an output equal to potential GDP. The deficits in the 'thirties were due to a precipitous decline in tax revenues, not a substantial increase in government expenditures. A substantial increase in government expenditures was needed to pull the economy out of depression, and this did not occur. As a result, one might argue that discretionary expansionary fiscal policy was not pursued during the Great Depression.

You might also like to view...

Which of the following is NOT true of the foreign-exchange market?

A) It is an over-the-counter market. B) Most foreign-exchange trading takes place in London. C) The busiest trading time is morning east coast time, when markets in New York and London are both open. D) Trading volume worldwide exceeds $1 trillion per day.

In competitive price-taker markets, firms

a. can sell all of their output at the market price. b. produce differentiated products. c. can influence the market price by altering their output level. d. are large relative to the total market.

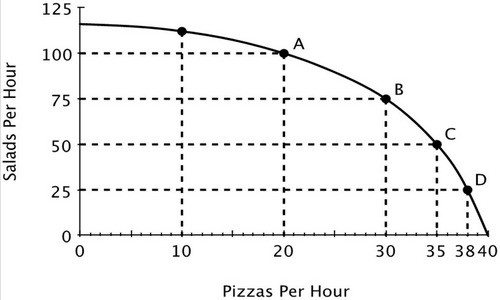

Refer to the accompanying figure. If this restaurant makes 75 salads in one hour, then what's the maximum number of pizzas it can make in that same hour?

A. 20 B. 0 C. 10 D. 30

Lanny is attempting to determine his firm’s economic profits for the previous year. He already knows what its accounting profits were. To calculate its economic profits, Lanny also needs to know the firm’s ______ for the previous year.

a. economic income b. implicit costs c. marginal benefits d. explicit losses