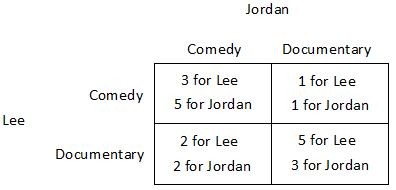

Suppose Jordan and Lee are trying to decide what to do on a Friday. Jordan would prefer to see a comedy while Lee would prefer to see a documentary. One documentary and one comedy are showing at the local cinema. The payoffs they receive from seeing the films either together or separately are shown in the payoff matrix below. Both Jordan and Lee know the information contained in the payoff matrix. They purchase their tickets simultaneously, ignorant of the other's choice.  Which of the following statements is true?

Which of the following statements is true?

A. For Lee, seeing a documentary is a dominant strategy.

B. Lee's dominant strategy depends on Jordan's choice.

C. For Lee, seeing a comedy is a dominant strategy.

D. Lee does not have a dominant strategy.

Answer: D

You might also like to view...

Laura's Pizza Place incurs $800,000 per year in explicit costs and $100,000 in implicit costs. The restaurant earns $1.3 million in revenues. Based on this information, what is the accounting profit for Laura's Pizza Place?

A) $200,000 B) $400,000 C) $500,000 D) $900,000

According to Porter's Five Competitive Forces Model, similar products produced by different firms within the industry affects a firm's ability to raise prices far more than substitutable products produced outside the industry

Indicate whether the statement is true or false

Under the Bretton Woods system, an asymmetry in the ability of central banks to defend their exchange rates existed because

A) a country experiencing a balance of payments surplus was limited in its ability to defend its exchange rate by its stock of international reserves. B) a country experiencing a balance of payments deficit was limited in its ability to defend its exchange rate by its stock of international reserves. C) central banks were allowed by the IMF to adjust their exchange rates upward whenever they chose, but were rarely allowed to adjust their exchange rates downward. D) central banks were allowed by the IMF to adjust their exchange rates downward whenever they chose, but were rarely allowed to adjust their exchange rates upward.

Suppose a coupon bond with a par value of $1000 is currently priced at $950 and has a coupon of $40. Which of the following is true?

A) current yield > coupon rate B) current yield < coupon rate C) coupon rate has risen D) coupon rate has declined