Based on this information, Jana will recognize

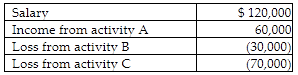

Jana reports the following income and loss:

Activities A, B, and C are all passive activities

A) adjusted gross income of $80,000.

B) salary of $120,000 and deductible net losses of $40,000.

C) salary of $120,000, passive income of $60,000, and passive loss carryovers of $100,000.

D) salary of $120,000 and net passive losses of $40,000 that will be carried over.

D) salary of $120,000 and net passive losses of $40,000 that will be carried over.

The losses from passive activities B and C may offset and eliminate the income from passive activity A resulting in a net passive loss of $40,000 ($60,000 income less $100,000 loss). The passive loss of $40,000 may not offset the salary and must be carried over to the next tax year.

You might also like to view...

Who among the following is the most appropriate person to start his or her own venture?

A. Gita, who has been an event manager for five years but discontinues her job as she wants to spend enough time with her one-year-old child B. Linda, who has been working as an assistant manager for over a year but cannot make decisions on her own C. Mira, who is intolerant of uncertainty and becomes emotionally depressed at the sign of any form of financial distress in her family D. Laura, who is against approaching others for funds and only has enough savings to keep her business afloat for one year

Some of the most common applications of real options are with property and insurance. A real estate option grants the holder the right to buy or sell a piece of property at an established price sometime in the future. If the price of the property goes ________, the owner of the option is likely to buy it. If the market value of the property ________ the strike price, the option holder is unlikely to execute the purchase.

A. up; goes above B. up; drops below C. down; goes above D. down; drops below

Minnesota has a statewide smoking ban for public places. However, the state statute includes an exemption that permits smoking by actors in theatrical performances. In order to take advantage of the exemption, the Old Clover Inn, located in Vadnais Heights, Minnesota, has begun holding theater night, every night. The Old Clover Inn has placed its pool tables in an area that is framed with theater

curtains and refers to the pool players as its actors. The Inn also has a stage for its cribbage players who sit and play cribbage and smoke. The Inn calls the nightly production, "As the Clover Turned," and it distributes a playbill that describes the nightly plays as involving "numerous uncredited actors in the role of bar patrons.". The Inn distributes buttons for $1 to patrons. The buttons read, "Act Now!" The Minnesota Health Department has warned the Inn that what it is doing is an attempt to circumvent the law. Which statement best describes the Old Clover Inn's approach to ethics? a. Old Clover Inn acts in a socially responsible manner, going above the requirements of the law in running a business. b. Old Clover Inn has found a perfectly legal way of doing business and compliance with the law is one standard for ethics. c. Old Clover Inn believes that ethics requires doing more than the law requires and less than the law allows. d. None of the above

One principal-agent conflict is that between a firm's creditors (as a principal) and its shareholders (as agent). For example, after issuing risky debt, stockholders have an incentive to increase the riskiness of the firm's assets (e.g

, by changing operating strategy), which would tend to expropriate wealth from creditors to stockholders. Which of the assumptions of an ideal capital market is violated in this example? a. Capital Markets are frictionless b. Homogeneous expectations c. Atomistic competition d. The firm has a fixed investment program e. Once chosen, the firm's financing is fixed