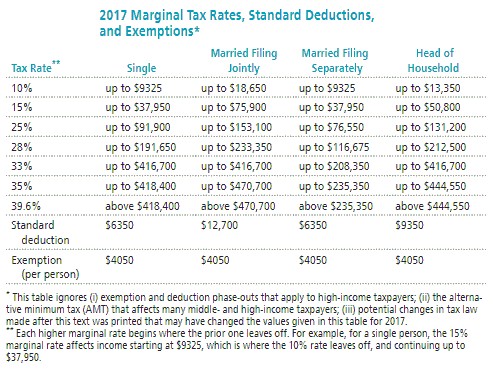

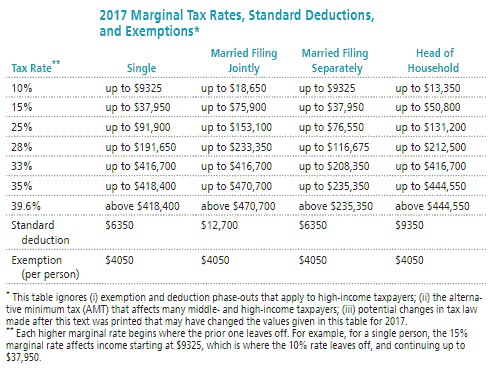

Solve the problem. Refer to the table if necessary. Caitlin is single and earned wages of $34,108. She received $300 in interest from a savings account. She contributed $511 to a tax-deferred retirement plan. She had $446 in itemized deductions from charitable contributions. Calculate her gross income.

Caitlin is single and earned wages of $34,108. She received $300 in interest from a savings account. She contributed $511 to a tax-deferred retirement plan. She had $446 in itemized deductions from charitable contributions. Calculate her gross income.

A. $33,897

B. $33,451

C. $34,408

D. $34,919

Answer: C

You might also like to view...

An annuity is a series of

A. equal payments with interest compounded annually. B. payments made at regular intervals in the future with interest compounded yearly. C. payments made at points in the future earning simple interest on a regular basis. D. equal payments made at regular intervals in the future with interest compounded at the end of each time period.

Answer the question.Stephen sets up an IRA with an APR of 4% compounded monthly at age 26. At the end of each month, he deposits $37 in the account. How much will the IRA contain when he reaches 65? Compare that amount to the total amount of deposits made over the time period.

A. $41,586.06; this is $24,270.06 more than the total amount of the deposits. B. $30,424.44; this is $19,772.46 more than the total amount of the deposits. C. $30,916.45; this is $16,116.45 more than the total amount of the deposits. D. $1003.17; this is $41.17 more than the total amount of the deposits.

Solve the problem. Refer to the table if necessary. John is married filing separately with taxable income of $172,163. Calculate the amount of tax owed.

John is married filing separately with taxable income of $172,163. Calculate the amount of tax owed.

A. $44,422 B. $49,538 C. $41,648 D. $39,983

Beginning December 31, 2014, ten equal, annual withdrawals are to be made. ? Required: ? Using the appropriate tables, determine the equal, annual withdrawals if $140,000 is invested on January 1, 2014 at an interest rate of 10% compounded annually.

What will be an ideal response?