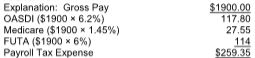

Jason's gross pay for the week is $1900. His year-to-date pay is under the limit for OASDI. Assume that the rate for state and federal unemployment compensation taxes is 6% and that Jason's year-to-date pay has not yet exceeded the $7000 cap. What is the total amount of payroll taxes that his employer must record as payroll tax expenses? (Do not round your intermediate calculations. Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%.)

A) $107.35

B) $117.80

C) $259.35

D) $233.74

C) $259.35

Business

You might also like to view...

It is highly unlikely that greater shareholder control of internal corporate governance will lead to greater corporate social responsibility.

Answer the following statement true (T) or false (F)

Business

When products differ in batch size and complexity, they usually consume different amounts of overhead resources.

Answer the following statement true (T) or false (F)

Business

Wicked problems are defined as:

a. problems without conflicting values b. large, complex social problems with no clear solution c. problems with clear and abundant information d. problems with obvious solutions

Business

Source documents are used to assign all manufacturing costs to jobs.

Answer the following statement true (T) or false (F)

Business